As I wade through the sea of companies that the markets have to offer, I often find myself caught in a tug of war with the business quality and competitive advantage on one side and the price at which it is offered in the market on the other. To identify a scenario when this balance tips in my favour and provides me with an opportunity to invest is what I constantly attempt to do. This analysis of Liberty Shoes is one such attempt.

Many investing veterans such as Peter Lynch and Warren Buffet advocate investing in businesses that we understand. Footwear is something that I use everyday and I felt that it would be easy to understand how the business works. As I was browsing through the listed companies in this space, I came across many familiar brands like Metro, Relaxo and Campus. Irrespective of whether they had a competitive advantage or not, I found it hard to believe that these companies could provide an investment opportunity with a margin of safety since the PE ratios were 87, 130 and 75.

Liberty Shoes, on the other hand was both a name I had heard of and it was trading at a relatively lower PE of about 40. Thus I attempted to analyse the company’s financials to check if the market was right at giving it a lower multiple and if it could provide me with an opportunity.

In the book Warren Buffett and the Interpretation of Financial Statements, the authors Mary Buffet and David Clark show how Warren looks for companies with a competitive advantage by studying the company’s financial statements line by line. I attempted to check whether Liberty Shoes Ltd. had any competitive advantage and business moat by going through its past 10 year financial statements as described in the book. I have shared some examples of taking up each line in the company financials and evaluated the metrics both on an absolute and relative basis.

Overview

Liberty Shoes was founded by Dharam Pal Gupta, Purshotam Das Gupta and, Rajkumar Bansal as Pal Boot House in 1954. The company was later incorporated as Liberty Shoes Ltd. in 1986. Liberty Shoes Ltd is engaged in the business of manufacturing and trading of footwear, accessories and lifestyle products through its retail and wholesale network

Competitive Advantage and Business Moat

The Income Statement

Revenue, Cost of goods sold and Gross Profit

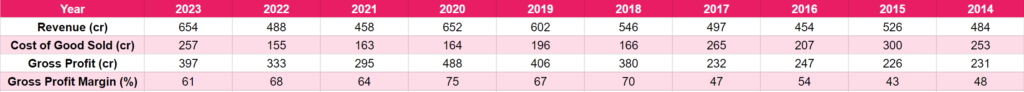

The company, in its latest annual report (2023), reported a revenue of about 650 crores. The revenue of the company has been growing at around 3% over the past 10 years, which is not very attractive. In the book, a 40% value was given as a general reference for the gross profit margin. Companies with more than 40% GPM consistently, are considered good.

“Companies that have excellent long-term economics working in their favour tend to have consistently higher gross profit margins“

The gross profit margin of Liberty Shoes seems to be consistently high.

Operating Expenses

Selling, General & Administrative Expenses (SGA)

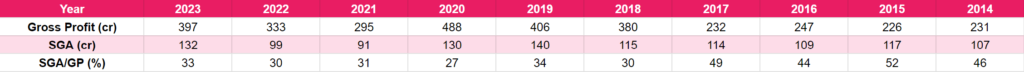

Warren looks for companies with a consistent SGA spending. Considering the SGA expense as a % of the gross profit margin, a value less than 30% is said to be fantastic.

Liberty Shoes has a value around 30% and it is consistent.

Research and Development (R&D)

Warren shows scepticism while dealing with companies that spend huge sums of money on R&D.

“Companies that have to spend heavily on R&D have an inherent flaw in their competitive advantage that will always put their long-term economics at risk, which means they are not a sure thing.“

I think the nature of business that Liberty Shoes operates in does not require R&D spending unlike something like a pharmaceutical company. The R&D spending is negligible. According to the 2023 annual report, the company has spent only 60 lakhs on R&D (0.09% of the turnover).

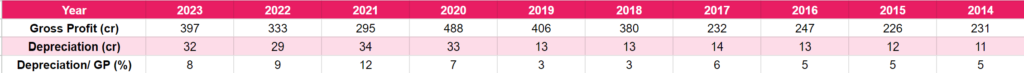

Depreciation

When taking a long term, value investing approach : “Warren believes that depreciation is a very real expense and should always be included in any calculation of earnings.”

Like all other expenses that eat away gross profits, with depreciation too, the lower the better. Some companies with competitive advantage like Coca-Cola, Wriggley’s and Procter and Gamble are said to have depreciation costs as a percentage of gross profits at about 6-8%

Liberty shoes seems to be able to pass in this parameter too.

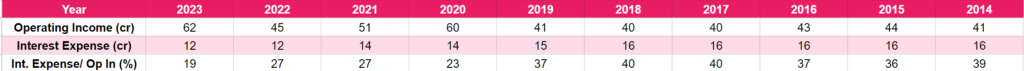

Interest Expenses

“As a rule, Warren’s favourite durable competitive advantage holders in the consumer products category all have interest pay-outs of less than 15% of operating income“

Companies like P&G and Wrigley’s are said to have this % as low as 8% or 7%

Warren however, also considers this value with respect to its industry peers. For example, Well’s Fargo had a value of 30%. However, it was the lowest amongst its peers. In investment banking, the average number is around 70%.

Let us take a look at some of Liberty Shoe’s competitors with respect to this value :

- Metro Brands

- Relaxo Footwears

- Bata India

- Campus Activewear

We can clearly see that Liberty Shoes performs poorly in this aspect when compared to some of its “high PE” competitors, indicating that its debt might be higher comparatively .

Exceptional Items

The exceptional, non recurring items are not a frequent or major occurrence with Liberty Shoes.

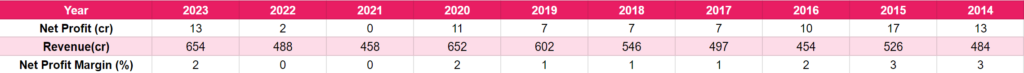

Net Profit

Warren looks for companies with a historical uptrend in the net profit. This is hardly the case with respect to Liberty shoes. This is partly due to the poor growth in revenue over the 10 years.

We can also see that the net profit margin is very poor both absolute and in comparison to its competitors.

Liberty Shoes’s poor growth in revenue and the company’s inability to convert the revenue into profits severely undermines its ability to boast a competitive advantage and business moat.

The Balance Sheet

Current Assets

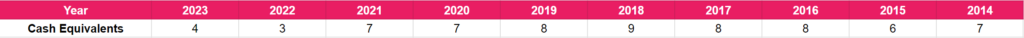

Cash and Cash Equivalents

In the book, it is recommended to check the past balance sheets of the company to determine if the cash accumulation was due to a one time sale of bonds or share or if it was from actual recurring business operations. Companies with durable advantage are said to have an increasing amount of cash and cash equivalents that their business generates.

The company’s cash does come from the business but its not growing and is small in number, indicating that it might not have any extra-ordinary advantage.

Inventory

“When trying to identify a manufacturing company with a durable competitive advantage, look for an inventory and net earnings that are on a corresponding rise”

Though the company’s inventory is rising, the rise is too slow, like its revenues. This, yet again indicates its lack of an outstanding business.

The rest of the financial statements

I shall pause my presentation of the financial statement analysis here. I went on to analyse the rest of the balance sheet elements and cash flow statements of the company. Liberty Shoes in most of the metrics failed to perform better or at least on par with its high PE peers. Measures like ROE too seem to be lagging in comparison. Going by what the authors describe as a “signs” of competitive advantage, I feel there is no discernible advantage / moat that Liberty Shoes has.

Valuation

From my analysis, I concluded that the market was indeed right at placing the company at a lower multiple. However, the question “how low?” needs an answer and I’ve attempted to answer that here. I’ve used a 3 part valuation method described here.

I think the company can continue to generate at least 6 or 7 crores a year, giving a value of about 100 crores for the first part. The second part contributes about 120-150 crores. Thus bringing the total value to about 250 crores. The market cap of the company is about 450 crores. Thus giving me a ratio of 22%-33%-45% for the 3 parts.

In the book, the authors describe Warren’s way of thinking of stocks like bonds with some yield. Let us consider the Pre-tax earnings of Liberty Shoes of nearly 17 crores or Rs 10 per share in pre tax earnings. Now if we were to look at it like a bond, we can come up with an yield equivalent of 10/250 = 4%. This is not a very attractive yield considering that the 10 year government bond rate is around 7% yield and the revenues are growing at a measly 3%.

Thus I feel that Liberty Shoes neither has an attractive price nor a competitive advantage, at the moment.

Books Behind the Analysis